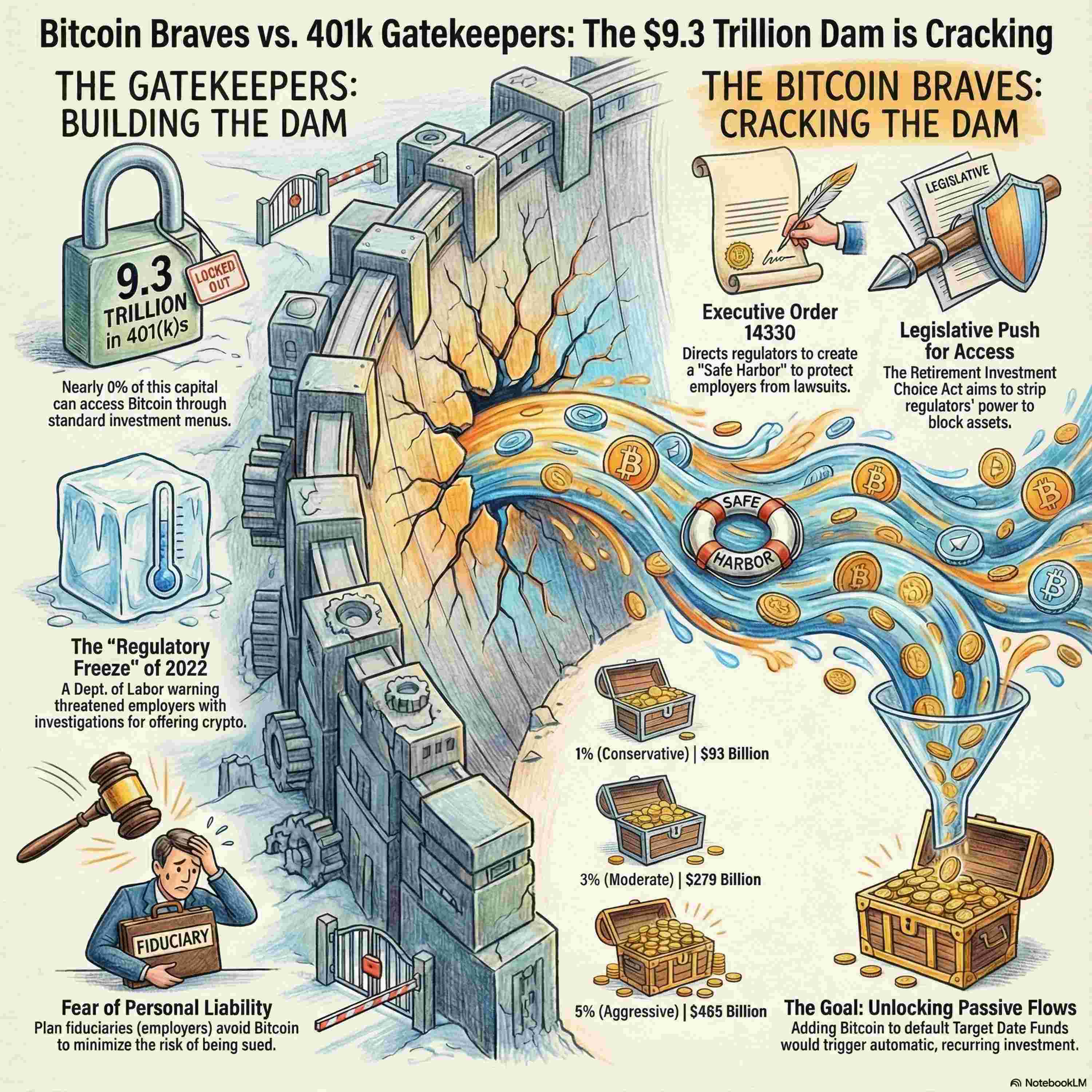

A fundamental conflict is underway over the allocation of Bitcoin in the American retirement system, specifically targeting the approximately $9.3 trillion held in 401(k) plans.

The central struggle pits the traditional "Gatekeepers"—the Department of Labor (DOL) and the plan fiduciaries who minimize liability—against the "Bitcoin Braves," a coalition of retail investors and legislative leaders. The Gatekeepers successfully imposed a "fiduciary freeze" by issuing 2022 guidance that warned employers to exercise "extreme care" before adding cryptocurrencies to 401(k) menus, threatening investigation programs for those who did. This created a chilling effect under the Employee Retirement Income Security Act (ERISA), preventing Bitcoin from reaching the standard "Core Menu" despite widespread approval of Bitcoin Exchange Traded Funds (ETFs).

The Bitcoin Braves initiated a legislative offensive in 2025 to dismantle these restrictions, arguing that current rules, like the definition of an "accredited investor," segregate the working class from high-yield alternative assets. Key actions included the introduction of the "Retirement Investment Choice Act" (H.R. 5748), which seeks to strip the DOL of its power to restrict asset classes based on perceived volatility, provided the investment structure is regulated.

The conflict reached a tipping point with Executive Order 14330, signed in August 2025, titled "Democratizing Access to Alternative Assets for 401(k) Investors". This order directs the DOL to rescind its restrictive 2022 warning and, critically, establish a Safe Harbor by February 2026. This safe harbor is designed to protect employers from litigation if they offer regulated digital assets as part of a diversified portfolio.

The ultimate goal is to move Bitcoin from the "Window" to the "Menu". Currently, investors can sometimes access Bitcoin ETFs through the Self-Directed Brokerage Window (SDBW), a high-friction "secret menu" used by less than three percent of employees. Utilizing the SDBW requires active intent, manual transfers, and often limits the allocation to fifty percent of the total portfolio. This friction acts as a dam, keeping capital out.

Removing this friction by adding Bitcoin to the default Core Menu is anticipated to generate massive passive flows. If Bitcoin ETFs are included in Target Date Funds (TDFs)—the "set it and forget it" funds that hold about $3.5 trillion—even a conservative one percent allocation would result in an automatic, mandatory $35 billion bid for Bitcoin. This fundamental change in default options is expected to institutionalize Bitcoin as a standard component of American retirement savings by 2026.

#Bitcoin #401k #Retirement #FinancialFreedom #DOL #ExecutiveOrder #TargetDateFunds #SafeHarbor #ETF #FinancialInclusion #PassiveFlow #ERISA #CoreMenu #CryptoRegulation