English Podcast starts at 00:00:00

Bengali Podcast starts at 00:13:31

Hindi Podcast starts at 00:28:56

Danish Podcast starts at 00:41:56

Reference

Eklund, J. C., & Mannor, M. J. (2026). Curious and analytical: How analysts evaluate and respond to executive communications about firm strategy. Strategic Management Journal, 1–32. https://doi.org/10.1002/smj.70063

Youtube Channel

https://www.youtube.com/@weekendresearcher

Connect over linkedin

https://www.linkedin.com/in/mayukhpsm/

Welcome to Revise and Resubmit 🎙️✨

Today, we are cracking open a paper with a title that reads almost like a personality test for Wall Street:

“Curious and analytical: How analysts evaluate and respond to executive communications about firm strategy”

Written by John C. Eklund and Michael J. Mannor, and published in the Strategic Management Journal 🧠📈

Yes, that Strategic Management Journal – a prestigious, field‑defining outlet on the FT50 list that sits at the top tier of management research. This is the kind of journal where ideas do not just appear, they arrive and then quietly change how everyone else thinks.

In this episode, we are stepping into the tense, caffeinated world of earnings calls ☕📞

You know the scene:

Executives talk about strategy.

Analysts listen, type, frown, nod.

Markets move. Screens glow. Silence, then questions.

But this paper asks a deceptively simple, deeply provocative question:

When executives talk strategy, especially growth strategy, what actually shifts inside the minds of analysts?

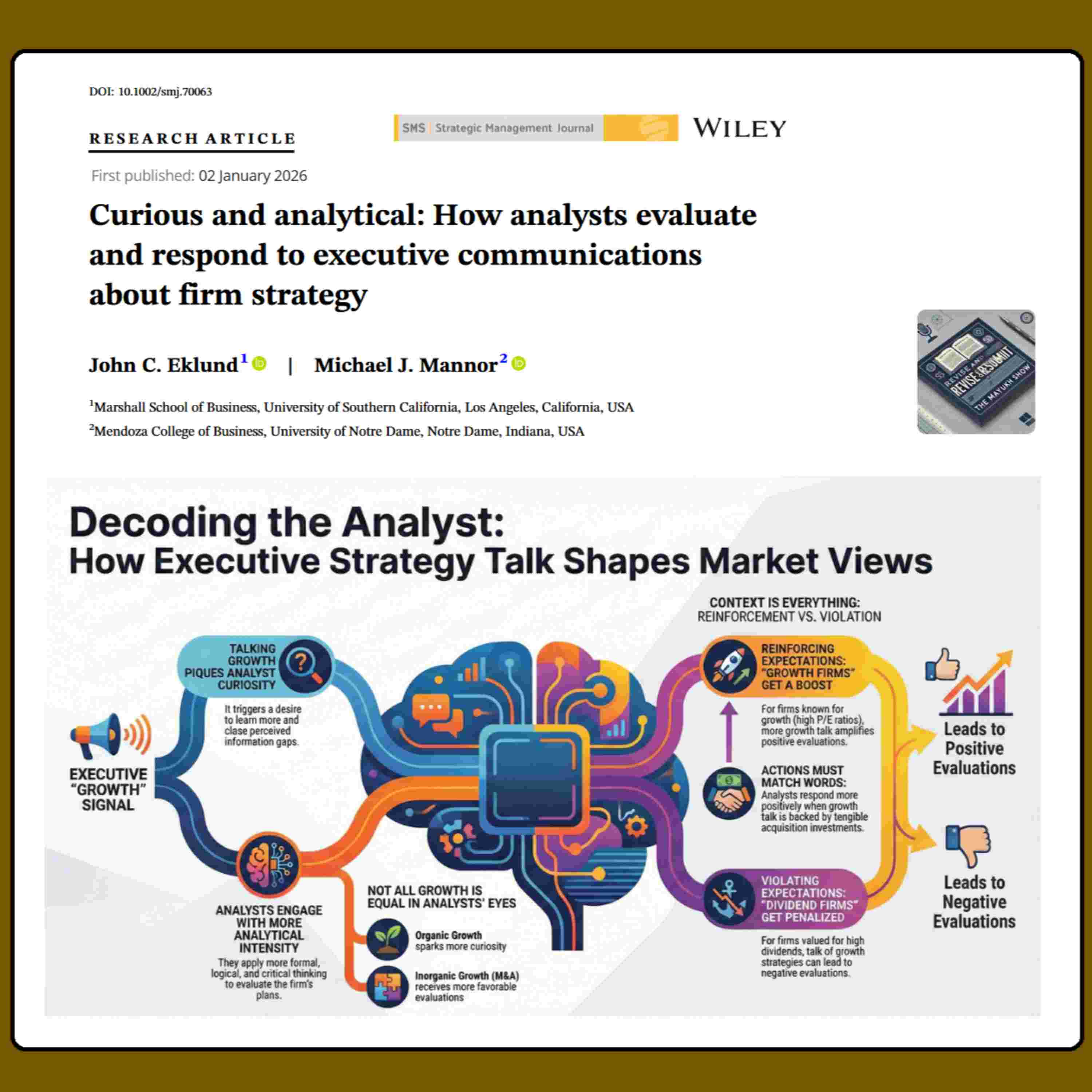

Eklund and Mannor show that when leaders lean into growth narratives, analysts do not just react with numbers. They react with cognition. Their language becomes:

more curious ❓

more formal 🧾

more logical and analytical 🔍

Using linguistic analysis tools, the authors trace how analysts become more inquisitive when a firm’s strategy violates their expectations. Internal growth, bold organic moves, unfamiliar twists in the story of the firm, all seem to light up this state of situational curiosity. The analysts start to probe. They write differently. They think differently.

Here is the twist:

That surge in curiosity and analytical depth partly explains why evaluations move. The way analysts think, not just what they hear, becomes the bridge between executive talk and market judgment. And yet, when it comes to acquisitions and mergers, the street still tends to reward them more generously with higher ratings and rosier price forecasts 💹

So, behind the forecasts and target prices, behind buy, hold, and sell, this article uncovers a quieter drama:

The constant negotiation between expectations and violations, between what analysts thought a firm would do and what executives now claim the firm will do.

In some S&P 500 firms, the same kind of strategy sounds safe, familiar, expected. In others, it feels like a plot twist. The strategy is similar, but the cognitive reaction is not. The evaluative frame shifts, and with it, the story of the company’s future.

This is not just about finance. It is a window into how framing, language, and surprise sculpt the mental models of powerful information intermediaries. It is about how curiosity itself becomes a strategic variable.

So as we dive into this FT50 powerhouse article from Strategic Management Journal, ask yourself:

🎧 When executives tell their strategy stories, are analysts really pricing cash flows, or are they quietly pricing how much their own expectations just got disrupted?

A huge thank you to John C. Eklund, Michael J. Mannor, and the publisher John Wiley & Sons Ltd. for this fascinating contribution to the literature 🙏📚

If you enjoy journeys like this into cutting‑edge research, remember to subscribe to “Revise and Resubmit” on Spotify, follow us on Amazon Prime and Apple Podcast, and check out our YouTube channel “Weekend Researcher” for more deep dives into academic work that actually changes how you think.