English Podcast Starts at 00:00:00

Bengali Podcast Starts at 00:13:37

Hindi Podcast Starts at 00:28:43

Chinese Podcast Starts at 00:44:06

Reference

Wang, H. (2025). Decoding Momentum Spillover Effects. Journal of Financial and Quantitative Analysis, 1–36. https://doi.org/10.1017/S002210902510238X

Youtube Channel

https://www.youtube.com/@weekendresearcher

Connect over linkedin

https://www.linkedin.com/in/mayukhpsm/

🎙️✨ Welcome back to Revise and Resubmit — the show where ideas meet insight, and research rewrites reality.

Today, we’re diving deep into the subconscious rhythm of financial markets — not the loud clang of opening bells, but the quiet tug between day and night, the push and pull of investor psychology.

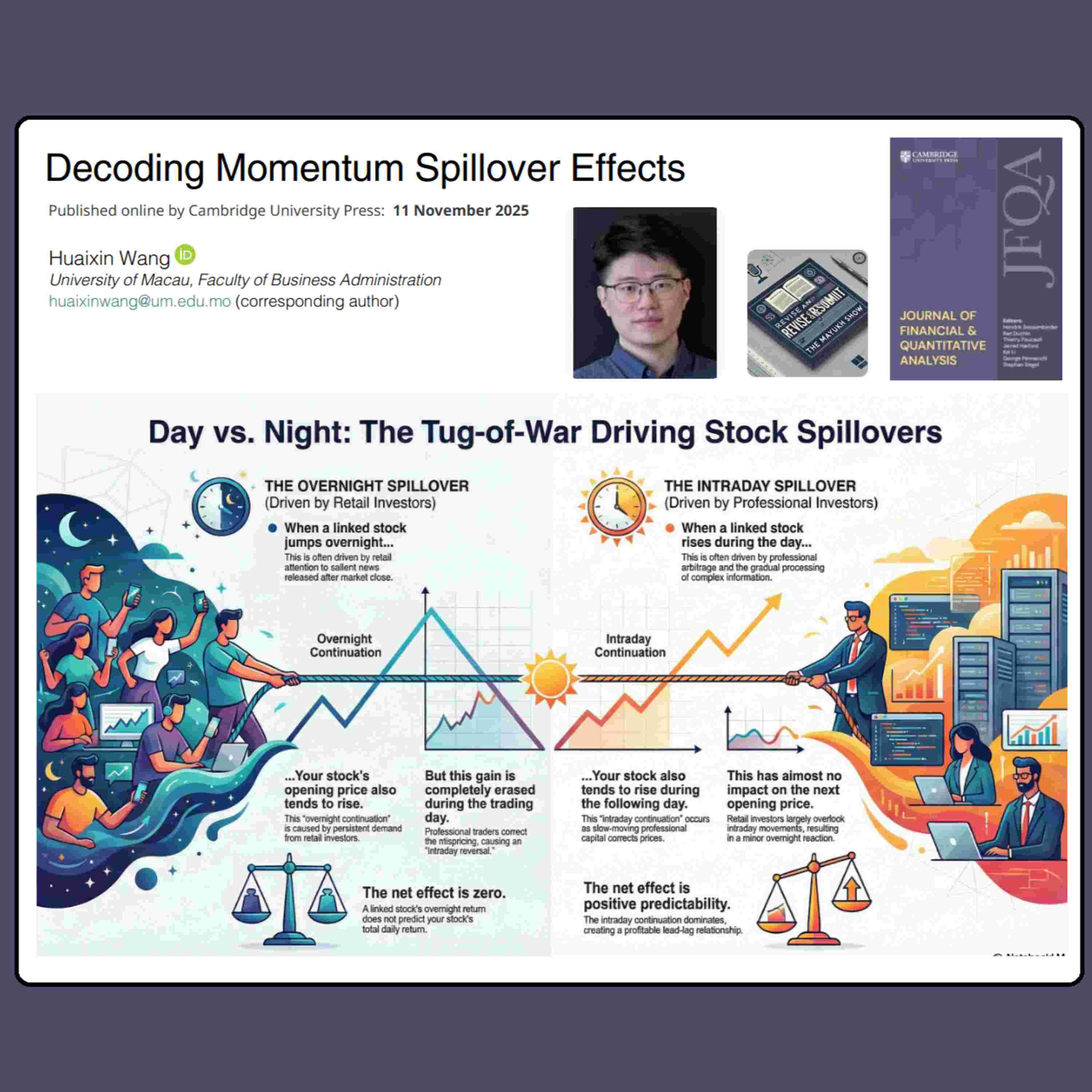

📈 The paper we’re exploring is titled “Decoding Momentum Spillover Effects” — written by Huaixin Wang, and published in the Journal of Financial and Quantitative Analysis, one of the prestigious journals from the FT50 list, proudly brought to us by Cambridge University Press on behalf of the Michael G. Foster School of Business, University of Washington. That’s right, we’re not just talking numbers here — we’re standing in the front row of academic finance.

Now picture this 🧠💡— every night, as some traders drift into sleep, their portfolios whisper to others across the market. When one stock’s overnight return twitches, its peers respond — as if a hidden thread connects them. But wait... by morning, that reaction doesn’t last. The price jolts awake, only to settle back, like a tide that rushed too far. And when the day begins anew, another rhythm takes over — this time, a more deliberate one, orchestrated by professionals and arbitrageurs who move with calculation, not impulse.

Huaixin Wang describes this drama as a cross-firm tug-of-war: a contest between persistent retail behavior and slow, corrective institution-driven rationality. In simpler terms — your midnight hunch meets someone else’s measured algorithm. The result? A fascinating cycle of temporary overreaction and gradual correction, revealing a hidden choreography between human bias and professional reasoning.

🤝 The study goes further — tracing how mutual funds and hedge fund flows weave into this dance, each group pulling markets in its own direction. What unfolds isn’t mere noise — it’s organized chaos that shapes how predictability seeps through financial networks.

And that’s what makes this research special: it doesn’t just quantify momentum. It decodes how emotions, structure, and strategy intermingle across firms, across time zones, across minds.

So the next time you see a sudden price bump before breakfast — ask yourself: is this a signal or just another echo from the night before? 🌒📊

🧩 What if every stock you track is actually responding to an unseen chorus — not just market forces, but the psychology of everyone around it?

That’s the mystery we explore today — because in the grand marketplace of ideas and investments, momentum doesn’t just spill over in data... it spills over in belief.

🎧 Stay tuned as we unpack this journey — and remember to subscribe to Revise and Resubmit on Spotify, follow our YouTube channel “Weekend Research”, and catch us on Amazon Prime Music and Apple Podcasts.

A massive thank you 🙏 to Huaixin Wang, to the Journal of Financial and Quantitative Analysis, and to Cambridge University Press for publishing this outstanding piece of scholarship. This one reminds us that good research doesn’t just report the market — it rethinks it.

🎙️ So, dear listener — how many of your own market moves are truly yours… and how many are just momentum, spilling over?