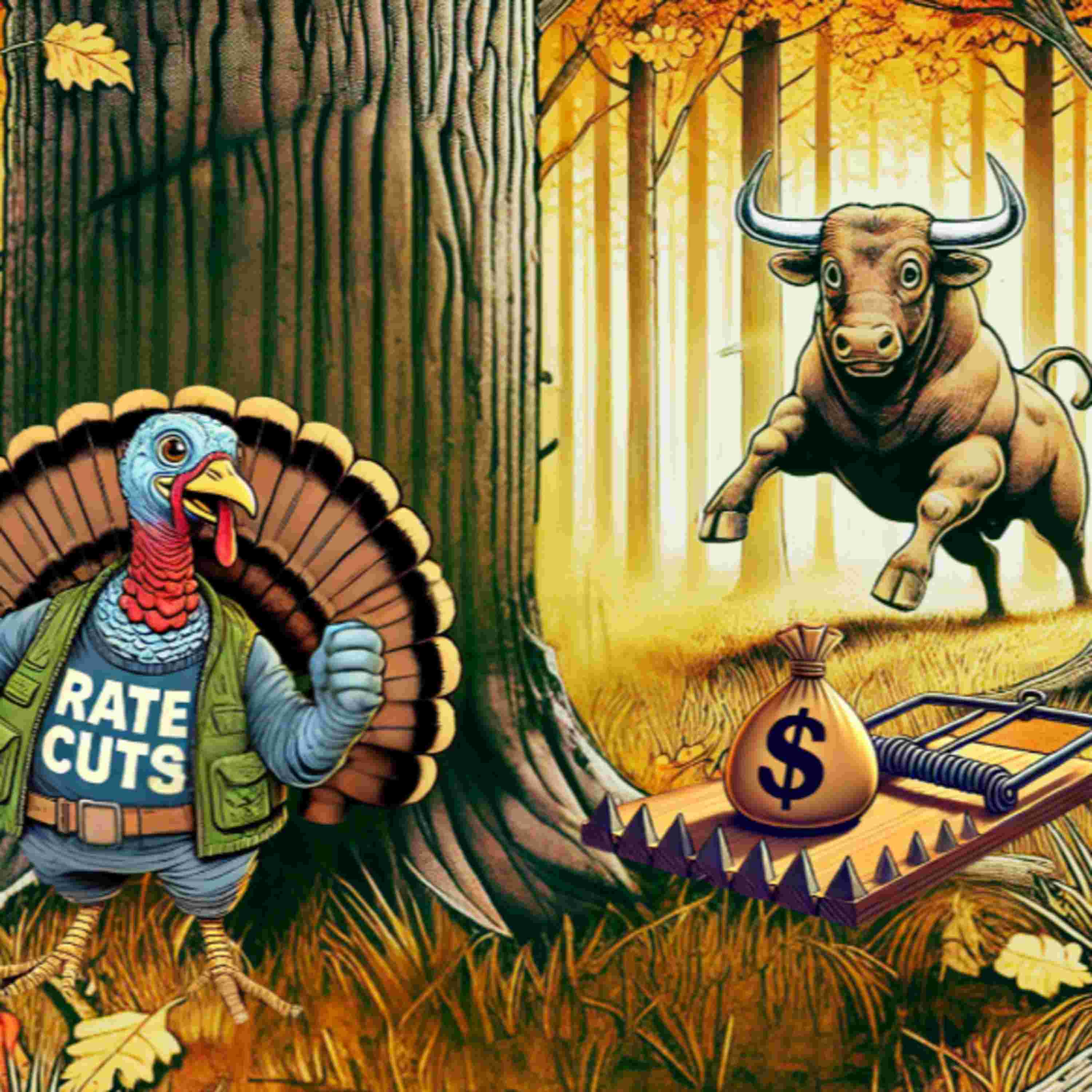

In this conversation, Mark from MPC Markets discusses the unrealistic expectations surrounding rate cuts in the financial market. He emphasizes that recent movements in rate expectations are not supported by economic data and are largely driven by media narratives and algorithms. Mark highlights the influence of a single Fed member's comment on market sentiment, despite the majority of Fed members expressing opposing views. He underscores the importance of understanding the context of these comments and the role of sentiment in shaping market reactions.

takeaways

• There is an unrealistic expectation of rate cuts in the market.

• Recent movements in rate expectations are not justified by economic data.

• Algorithms play a significant role in shaping market sentiment.

• The narrative around rate cuts is being recycled in the media.

• Only one Fed member's comment has influenced the current sentiment.

• The majority of Fed members are not supporting the rate cut narrative.

• Market reactions can be driven by sentiment rather than fundamentals.

• The financial market is influenced by trending articles and news cycles.

• Understanding the context of Fed comments is crucial for market analysis.

• Rate cut optimism can create a false sense of security in the market.